Tool rates

What the rate is and how it is calculated

How it is calculated

The toll is calculated by multiplying the Km of the route traveled by the unit rate, increased by a fee under ANAS's competence (Law 102/2009 and 122/2010) for each kilometer traveled. The kilometers for which the unit rate is multiplied refer not only to the distance from toll booth to toll booth, but also to the length of junctions, access ramps, and free motorway sections before and after the toll booth that have been built and are managed by the concessionaire. VAT must be added to the amount thus obtained, and rounding applied, either up or down, to the nearest 10 euro cents. The rounding is applied automatically without any discretion on the part of SAT and is regulated by the Interministerial Decree n. 10440/28/133 of November 12, 2001 of the Ministry of Infrastructure and Transport and the Ministry of Economy and Finance. The unit rate applied depends on the type of vehicle used (5 classes) and the characteristics of the motorway sections traveled (plain or mountain).

The annual increase in the unit rate is applied based on a mathematical formula determined by the Transport Regulation Authority, the application effects of which are communicated, following the annual rate update procedure, with an interministerial decree signed by the Minister of Infrastructure and Transport and the Minister of Economy, after receiving the opinion of the same Transport Regulation Authority. However, due to rounding to the nearest 10 cents, the final increase in the toll, between an entry and an exit toll booth, may be higher, lower, or none compared to the annual increase in the unit rate. It may happen that the toll, on some sections, does not increase for several years and the annual increase is recovered, cumulated, in a subsequent year.

UNIT RATE PER KM

The applied unit rate depends on the following elements:

SAT UNIT RATES

(including ANAS fee pursuant to law 102/2009 and 122/2010 and VAT) February 1, 2025.

Please note that for residents in one of the ten Municipalities of the Lower Cecina Valley who hold an Electronic Toll Collection contract, the tariff concession pursuant to the Exemption Protocol of May 22, 2012 is available

TYPE OF VEHICLE USED (5 CLASSES)

n the sections of Autostrade per l'Italia and on almost all other Concessionaires, vehicle classification is carried out based on physically measurable elements such as:

- The profile - i.e., the height of the vehicle on the perpendicular of the front axle - for 2-axle vehicles (classes A, B

- The number of axles for vehicles or convoys with more than two axles (classes 3, 4, 5).

| CLASS | A | B | 3 | 4 | 5 |

|---|---|---|---|---|---|

| Mountain rate €/Km | 0,20973 | 0,21492 | 0,29182 | 0,45793 | 0,53055 |

| Class A Height ≤ 1.3m (measured at the front axle) | |||||

| Class B Height ≤ 1.3m (measured at the front axle) | |||||

| Class 3 | |||||

| Class 4 | |||||

| Class 5 | |||||

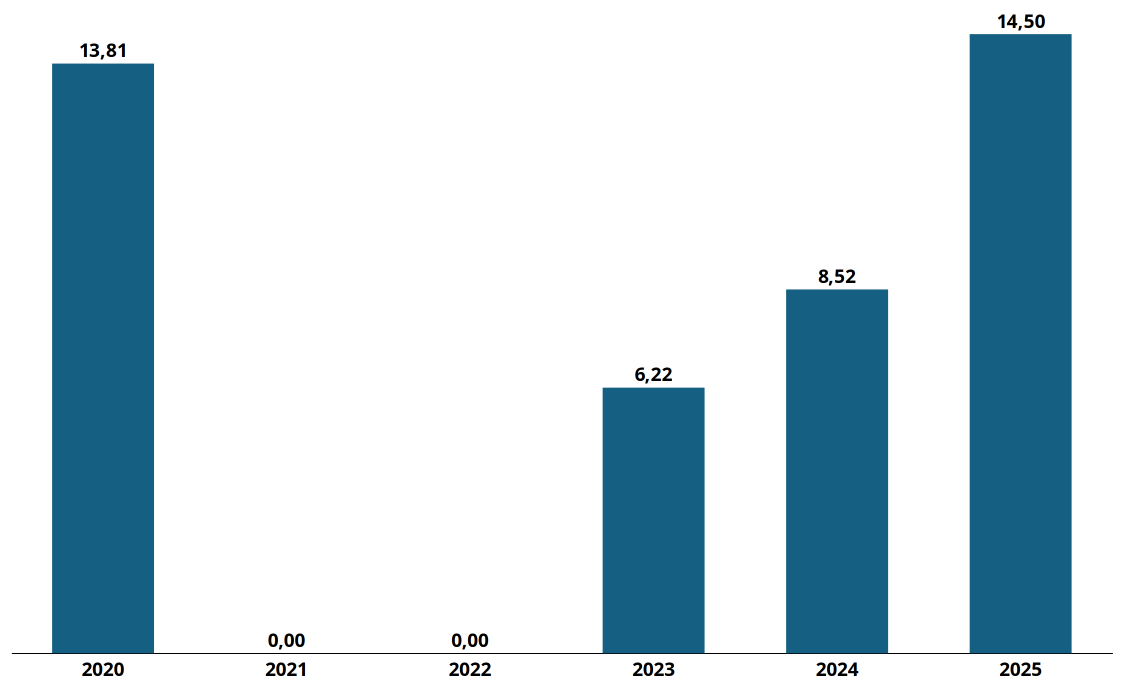

Tariff increases over the last 6 years

YEAR 2020

Based on the decree of October 21, 2020 of the commissioner ad ACTA, a tariff increase of 2.54% was applied for the year 2014;

Based on the decree of October 27, 2020 of the commissioner ad ACTA, a tariff increase of 9.03% was applied for the year 2016;

Based on the decree of October 27, 2020 of the commissioner ad ACTA, a tariff increase of 1.95% was applied for the year 2017;

Based on the decree of October 28, 2020 of the commissioner ad ACTA, a tariff increase of 0.29% was applied for the year 2018.

YEAR 2021

The tariff increase was 0.00%

YEAR 2022

The tariff increase was 0.00%

YEAR 2023

Based on the decree of September 25, 2023 of the commissioner ad ACTA, a tariff increase of 6.22% was applied from December 1, 2023 for the year 2017.

YEAR 2024

Based on the decree of December 30, 2023 of the MIT, a tariff increase of 2.30% was applied from January 1, 2024 for the year 2024;

Based on the decree of September 25, 2023 of the commissioner ad ACTA, a tariff increase of 0.63% was applied from July 1, 2024 for the year 2017;

Based on the decree of September 25, 2023 of the commissioner ad ACTA, a tariff increase of 5.59% was applied from July 1, 2024 for the year 2018.

YEAR 2025

Based on the decree of December 9, 2021 of the commissioner ad ACTA, a tariff increase of 3.18% was applied from February 1, 2025 for the year 2015.

Based on the decrees of 9 December 2021 and 14 October 2024 of the commissioner ad ACTA, a tariff increase of 11.32% was applied from September 1, 2025 for the years 2015 and 2016.

Characteristics of the motorway sections traveled

The unit rate takes into account the costs of construction, management, and maintenance of the motorway sections (this is why mountain sections, with many viaducts and tunnels, cost more).

Concessionary company managing the section

In the case of routes that include multiple motorway companies, it is necessary to calculate separately the kilometers and unit rates of each one before applying the rounding.

ROUNDING

The rounding is applied automatically without any discretion on the part of the concessionaire and is regulated by Interministerial Decree n. 10440/28/133 of November 12, 2001 of the Ministry of Infrastructure and Transport and the Ministry of Economy and Finance.

The rounding system provides that if the toll due has a final figure lower than 5 euro cents, the toll paid by the user is rounded down to the lower 10 cents; if the final figure is equal to or higher than 5 cents, the toll for the user is rounded up to the higher 10 cents. So for example, if the toll is €1.13, the amount to be paid is rounded to €1.10; if the toll is €1.16, it is rounded to €1.20.

SAT Tolls

Below are the user tolls for each vehicle class and for origins and destinations within the motorway route managed by SAT:

Collesalvetti – Rosignano Marittimo section

| Class |

Toll from September 01, 2025 on the route Collesalvetti - Rosignano M.mo and vice versa (including ANAS fee pursuant to law 102/2009, ANAS tariff increases pursuant to law 122/2010, VAT and rounding) |

|---|---|

| A | 6,50 € |

| B | 6,70 € |

| 3 | 9,00 € |

| 4 | 14,20 € |

| 5 | 16,40 € |

Collesalvetti - Rosignano Barrier (San Pietro in Palazzi) section

| Class |

Toll from September 01, 2025 on the route Collesalvetti - Rosignano Barrier and vice versa (including ANAS fee pursuant to law 102/2009, ANAS tariff increases pursuant to law 122/2010, VAT and rounding) |

|---|---|

| A | 7,10 € |

| B | 7,30 € |

| 3 | 9,90 € |

| 4 | 15,60 € |

| 5 | 18,00 € |

Open system section Rosignano - San Pietro in Palazzi

| Class |

Toll from September 01, 2025 on the route Rosignano - San Pietro in Palazzi and vice versa (including ANAS fee pursuant to law 102/2009, ANAS tariff increases pursuant to law 122/2010, VAT and rounding) |

|---|---|

| A | 0,90 € |

| B | 1,00 € |

| 3 | 1,30 € |

| 4 | 2,10 € |

| 5 | 2,40 € |

Civitavecchia - Tarquinia section*

| Class |

Toll from September 01, 2025 on the route Civitavecchia - Tarquinia and vice versa (including ANAS fee pursuant to law 102/2009, ANAS tariff increases pursuant to law 122/2010, VAT and rounding) |

|---|---|

| A | 1,10 € |

| B | 1,20 € |

| 3 | 1,60 € |

| 4 | 2,50 € |

| 5 | 2,90 € |

* the route is tolled for only 5.4 km.

Tolls on the national highway network

To find out user tolls by vehicle class for all remaining highway routes. click here.